(5) | Total fee paid: |

☐ | ||

Fee paid previously with preliminary |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

(1) | Amount previously paid: |

(2) | Form, Schedule or Registration Statement |

(3) | Filing Party: |

��

(4) | Date Filed: |

1160 Dairy Ashford Rd., Suite 160

Houston, Texas 77079

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

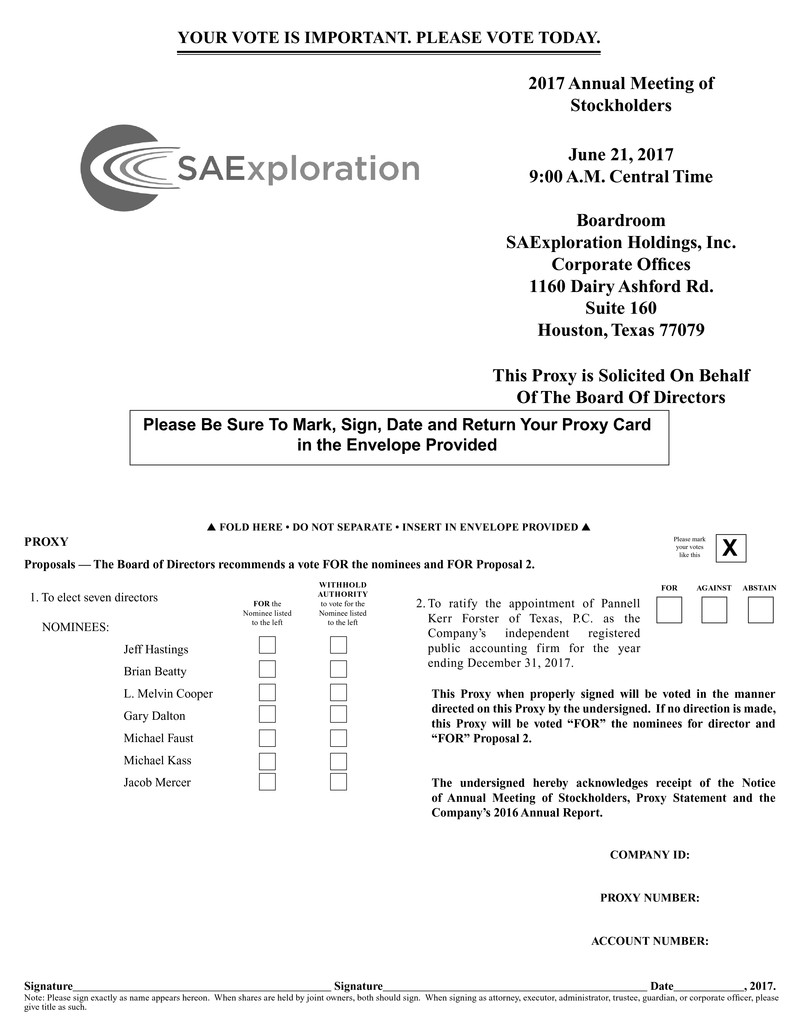

TO BE HELD ON JUNE 21, 2017

To the annual meeting of stockholdersStockholders of SAExploration Holdings, Inc., a Delaware corporation,:

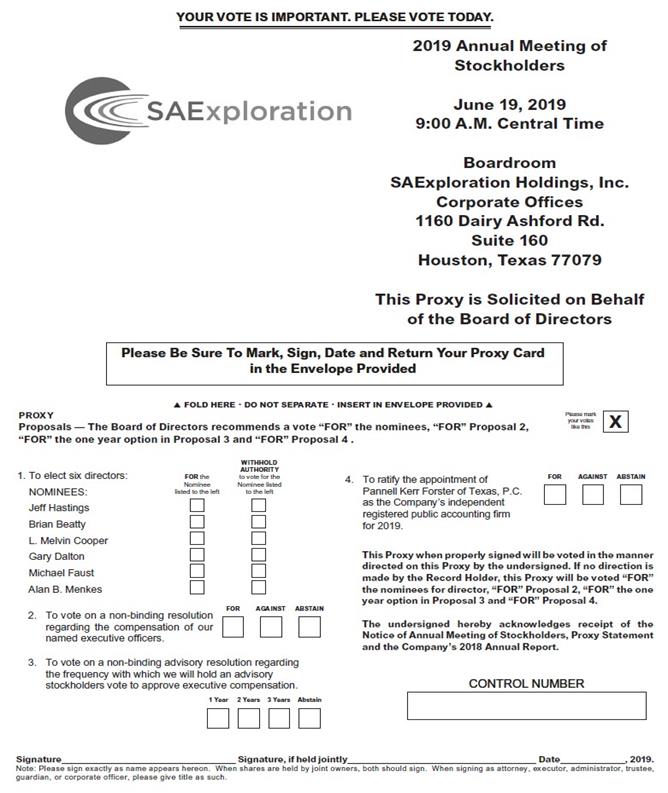

The 2019 Annual Meeting of Stockholders (the “Annual Meeting”) of SAExploration Holdings, Inc. (“the Company”) will be held at its corporate offices, 1160 Dairy Ashford Rd, Suite 160, Houston, TX 77079, on June 19, 2019 at 9:00 a.m., Central Time on June 21, 2017, in the Boardroom at the corporate offices of SAExploration Holdings, Inc., located at 1160 Dairy Ashford Rd., Suite 160, Houston, Texas 77079. You are cordially invited to attend the annual meeting, which will be held for the purpose of voting on the following purposes:

(1) | to elect |

(2) | to vote on a |

(3) | to vote on a non–binding advisory resolution regarding the frequency with which the Company will hold an advisory stockholder vote to approve executive compensation (the “frequency of say–on–pay proposal”); |

(4) | to vote on whether to ratify the selection of Pannell Kerr Forster of Texas, P.C. as |

(5) | to transact such other business as may properly come before the |

OurThe Board of Directors has approved and recommends that you vote “FOR” the election of the six nominated directors, “FOR” the election of the seven nominated directors, consisting of Jeff Hastings, Brian Beatty, L. Melvin Cooper, Gary Dalton, Michael Faust, Michael Kass, and Jacob Mercer and "say–on–pay proposal, “FOR"” one year for the frequency of say–on–pay proposal, and “FOR” the ratification of the selection of Pannell Kerr Forster of Texas, P.C. as the Company’s independent registered public accounting firm for 2019

Only stockholders of record at the close of business on April 26, 2019 will be entitled to vote at the Annual Meeting.

Your vote is important regardless of the number of shares you own. Whether or not you plan to attend the annual meeting,Annual Meeting, please sign, date and return to us your proxy card to the Company as soon as possible so that your shares will be voted at the meeting.Annual Meeting. If you hold your shares are held in a “street name” or are in a margin or similar account, you should contact your bank, broker or other similar organization to ensure that votes related to the shares you beneficially own are properly counted.

Thank you for your participation. We lookThe Company looks forward to your continued support.

By Order of the Board of Directors,

/s/ Brent Whiteley

Brent Whiteley

Chief Financial Officer, General Counsel, and Secretary

This proxy statement is dated April 28, 2017,30, 2019 and is first being mailed to ourthe Company’s stockholders on or about May 12, 2017.

1 | |

5 | |

6 | |

8 | |

8 | |

8 | |

8 | |

8 | |

9 | |

10 | |

11 | |

11 | |

11 | |

12 | |

12 | |

13 | |

Proposal 3— Advisory Vote on the Frequency of Future Say–on–Pay Votes | 14 |

15 | |

15 | |

18 | |

18 | |

18 | |

Securities Authorized for Issuance under Equity Compensation Plans | 19 |

20 | |

Security Ownership of Certain Beneficial Owners and Management | 20 |

21 | |

22 | |

22 | |

23 | |

24 | |

24 | |

24 | |

24 | |

24 |

i

Why am I receiving this proxy statement?

The Company is furnishing you these materials because its Board of Directors (the “Board”) is soliciting your proxy to vote your shares at the Annual Meeting. This proxy statement includes information that the Company is required to provide you under the rules and regulations of the Securities and Exchange Commission (the “SEC”) and is designed to assist you in voting your shares.

The Board is asking for your proxy. This means you authorize persons selected by the Company to vote your shares at the Annual Meeting in the way that you instruct. All shares represented by valid proxies received and not revoked before the Annual Meeting will be voted in accordance with the stockholder’s specific voting instructions.

Why did I receive a notice in the mail regarding the Internet availability of the proxy materials?

In accordance with the rules and regulation of the SEC, the Company is furnishing the proxy materials via the internet to all stockholders entitled to vote at the Annual Meeting instead of mailing a printed copy of the proxy materials. The Company believes that posting these materials on the Internet enables the Company to provide stockholders with the information that they need more quickly, while lowering the costs of printing and delivery and reducing the environmental impact of the Annual Meeting.

If you received a notice in the mail regarding the availability of proxy materials on the internet (the “Notice of Internet Availability”), you will not receive a printed copy of the proxy materials unless you request one. The Notice of Internet Availability will instruct you as to how you may access and review the proxy materials and submit your proxy via the internet. If you would like to receive a printed copy of the proxy materials, please follow the instructions in the Notice of Internet Availability for requesting printed materials.

What is the record date and who is entitled to vote?

The Board set April 26, 2019, as the record date. As of the record date, there were 4,290,697 shares of the Company’s common stock outstanding. Each share of common stock outstanding on the record date is entitled to one vote on any matter properly presented at the Annual Meeting.

What is a stockholder of record?

A stockholder of record or registered stockholder is a stockholder whose ownership of the Company’s common stock is reflected directly on the books and records of the Company’s transfer agent, Continental Stock Transfer and Trust Company. If you hold the Company’s common stock through an account with a bank, broker or other similar organization, you are considered the beneficial owner of shares held in street name and are not a stockholder of record. For shares held in street name, the stockholder of record is your bank, broker or other similar organization. The Company only has access to ownership records for the registered shares.

How do I vote?

You may vote by any of the following methods:

In person. Stockholders of record and beneficial owners of shares held in street name may vote in person at the Annual Meeting. If you hold shares in street name, you must also obtain a legal proxy from the stockholder of record (e.g., your bank, broker or other similar organization) to vote in person at the Annual Meeting.

Via the internet. Stockholders of record may vote via the Internet by following the instructions included in the Notice of Internet Availability provided. If you are a beneficial owner of shares held in street name, your ability to vote via the Internet depends on the voting procedures of the stockholder of record (e.g., your bank, broker or other similar organization). Please follow the directions included in the Notice of Internet Availability provided to you by the stockholder of record.

By mail. Stockholders of record and beneficial owners of shares held in street name who received the Company’s proxy materials by mail may vote the proxy by completing, signing, dating and returning the proxy card or voting instruction form provided by the stockholder of record.

You may revoke your proxy or change your vote at any time prior to the taking of the vote at the Annual Meeting by either submitting a written notice of revocation to the Company’s Secretary at the address set forth below or attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically make that request or vote in person at the meeting. For all methods of voting, the last vote cast will supersede all previous votes.

What are my voting choices when voting for director nominees, and what vote is needed to elect directors?

In voting on the election of six director nominees to serve until the 2020 Annual Meeting of Stockholders, or until the director’s earlier death, resignation, disqualification or removal, stockholders may vote for each nominee in one of the following ways:

for the nominee; or

withhold votes as to the nominee.nominee; or

abstain from voting on the nominee.

The nominees receiving a plurality of votes cast at the Annual Meeting will be elected as directors.

What are my voting choices when voting on the non–binding advisory resolution regarding compensation of the Company’s named executive officers as disclosed in this proxy statement, and what vote is needed to approve the resolution?

In voting on the non–binding advisory resolution regarding compensation of the Company’s named executive officers as disclosed in this proxy statement, stockholders may vote in one of the following ways:

for the resolution;

against the resolution; or

abstain from voting on the resolution.

The proposal to approve the non-binding advisory resolution regarding compensation of the named executive officers will require the affirmative vote of a majority of the shares of the Company’s common stock present in person or represented by proxy at the Annual Meeting.

What are my voting choices when voting on the non–binding advisory resolution regarding the frequency of future stockholder votes regarding compensation of the Company’s named executive officers, and what vote is needed to approve the resolutions?

In voting on the non–binding advisory resolution regarding the frequency of future stockholder votes regarding compensation of the Company’s named executive officers, stockholders may vote in one of the following ways:

every year;

every two years;

every three years; or | ||

abstain from voting on the resolution.

The proposal to approve the non–binding advisory resolution regarding the frequency of future stockholder votes regarding compensation of the Company’s named executive officers requires the affirmative vote of a plurality of the issued and outstanding shares of common stock represented in favorperson or by proxy at the Annual Meeting.

What are my voting choices when voting on the ratification of the appointment of Pannell Kerr Forster of Texas, P.C. as the Company’s independent registered public accounting firm, and what vote is needed to ratify their appointment?

In voting to ratify the appointment of Pannell Kerr Forster of Texas, P.C. as the Company’s independent registered public accounting firm for 2019, stockholders may vote in one of the following ways:

for ratification;

against ratification; or

abstain from voting on ratification.

The proposal to ratify the appointment of Pannell Kerr Forster of Texas, P.C. will require the affirmative vote of a majority of the shares of the Company’s common stock present in person or represented by proxy at the Annual Meeting.

What if I do not specify a choice for a matter when returning a proxy card?

If you are a stockholder of record and sign and return a proxy card without giving any instructions, your proxy will be voted “FOR” the election of all director nominees, “FOR” the say–on–pay proposal, “FOR” one year on the frequency of say–on–pay proposal, and “FOR” the proposal to ratify the appointment of Pannell Kerr Forster of Texas, P.C. as the Company’s independent registered public accounting firm for 2019. If you hold your shares in street name and do not provide your bank, broker or other similar organization with voting instructions (including by returning a blank voting instruction card), your shares may constitute “broker non–votes.” Generally, broker non–votes occur on a matter when a bank, broker or other similar organization is not permitted to vote on that matter without instructions from the beneficial owner and instructions are not given.

What constitutes a quorum for the Annual Meeting?

The Company needs a quorum of stockholders to hold a validly convened Annual Meeting. The presence, in person or by proxy, of the holders of a majority of the outstanding shares of common stock constitutes a quorum. If you have signed and returned a proxy card, your shares will be counted toward the quorum. If a quorum is not present, the chairman may adjourn the meeting, without notice other than by announcement at the meeting, until the required quorum is present. As of the record date, 4,290,697 shares of common stock were outstanding. Thus, the presence in person or represented by proxy of the holders of common stock representing at least 2,145,349 shares will be required to establish a quorum.

How are withheld votes, abstentions and broker non–votes counted?

A properly executed proxy card marked “withhold” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum. Abstentions and broker non–votes are counted for purposes of determining whether a quorum is present at the Annual Meeting.

With respect to the say–on–pay proposal, the frequency on say–on–pay proposal or the proposal to ratify the appointment of the independent registered public accounting firm, an abstention from voting will have the same effect as a vote “against” the proposal.

Broker non–votes will have no effect on the outcome of the vote on any of the proposals.

Will any other business be transacted at the Annual Meeting? If so, how will my proxy be voted?

The Company does not know of any business to be transacted at the Annual Meeting other than those matters described in this proxy statement. The Company believes that the periods specified in its Second Amended and Restated By–laws, as amended (the “By–laws”) for submitting proposals to be considered at the Annual Meeting have passed and no proposals were submitted. However, should any other matters properly come before the Annual Meeting, and any adjournments or postponements of the Annual Meeting, shares as to which voting authority has been granted to the proxies will be voted by the proxies in accordance with their judgment.

The Company intends to announce preliminary voting results at the Annual Meeting and will publish final results in a Current Report on Form 8–K within four business days of the Annual Meeting. What is the deadline for submitting proposals to be considered for inclusion in the 2020 proxy statement and for submitting a nomination for director for consideration at the Annual Meeting of Stockholders in 2020? The Company expects to hold its 2020 Annual Meeting of Stockholders on or about June 10, 2020. Stockholder proposals requested to be included in the 2020 proxy statement must be received no later than December 31, 2019. Director nominations and proposal for matters to be considered at the 2020 Annual Meeting of Stockholders must be received by the Company between March 21, 2020 and April 20, 2020. Proposals and nominations should be directed to Brent Whiteley, Chief Financial Officer, General Counsel, and Secretary, SAExploration Holdings, Inc., | ||

Who is paying the costs associated with soliciting proxies for the Annual Meeting?

The Company is paying the cost of soliciting proxies and will reimburse its transfer agent, brokerage firms, financial institutions and other custodians, nominees, fiduciaries and holders of record for their reasonable out–of–pocket expenses for sending proxy materials to stockholders and obtaining their proxies. In addition to soliciting the proxies by mail and the Internet, certain of the Company’s directors, officers and employees, without compensation, may solicit proxies personally or by telephone, facsimile and e-mail.

Who can help answer my questions?

If you have questions about the Annual Meeting or if you need printed copies of this proxy statement, the proxy card or other proxy materials you should contact:

Ryan Abney — Vice President, Finance

SAExploration Holdings, Inc.

1160 Dairy Ashford Rd., Suite 160

Houston, Texas 77079

Telephone: (281) 258-4409

Email: rabney@saexploration.com

The Company’s Board of Directorscurrently consists of seven members, all of which six members were appointed toelected at the Board effective upon the completion2018 Annual Meeting of the Restructuring on July 27, 2016, and of which one member was appointed in January 2017.Stockholders. The directors to be elected at the annual meetingthis Annual Meeting will serve on the Board until our next annual meeting in 2018 orthe 2020 Annual Meeting of Stockholders, until their successors are elected and qualified or until their earlier death, resignation, disqualification or retirement. The currentremoval. All but one of the directors are standing for reelection are: Jeff Hastings, Brian Beatty, L. Melvin Cooper, Gary Dalton, Michael Faust, Michael Kass,reelection. Mr. Mercer has decided not to run for election and Jacob Mercer. Stockholders maythe Board has reduced the size of the Board to six members. Mr. Mercer has not voteadvised the Company of any disagreement with the Company in his decision not to run for persons not named in this proxy statement to serve as a director.

Although the Company knows of no reason to believe thatwhy any of the nominees willwould not be unable or unwillingable to serve, if elected. However, if any nominee should become unable or unwilling to serve for any reason, proxies may be voted for another person nominated as a substitute by our Board of Directors, or subject to certain limitations contained in our second amended and restated bylaws, the Board may reduceeither the number of directors.

The nominees receiving a plurality of votes cast at the annual meetingAnnual Meeting will be elected as directors. Votes to withhold authority and broker non-votesnon–votes are counted for purposes of determining the presence or absence of a quorum for the transaction of business but will not affect the election outcome.

The Nominating Committee and the Board of Directors believe that each of the nominees possesses the qualities and experience that it believes ourthe Company’s directors should possess, as described in detail below. The nominees for election to the Board, together with their biographical information and the Nominating Committee's and our Board’s reasons for nominating them to serve as directors, are set forth below.possess. No family relationshiprelationships exists between any of the directors or the Company’s executive officers listed in the “Executive Compensation — Our Executive Officers” portion of this proxy statement on page 12.

The Board of Directors recommends athat stockholders vote “FOR” the election of each of the nominees listed below.

Listed below are the six persons nominated for election to the Board. The following paragraphs include information about each director nominee’s business background, as furnished to the Company by the nominee, and additional experience, qualifications, attributes or skills that led the Nominating Committee and the Board to conclude that the nominee should serve on the Board.

Name |

| Age |

| Director Since |

Jeff Hastings |

| 61 |

| 2011 |

Brian Beatty |

| 56 |

| 2011 |

L. Melvin Cooper |

| 65 |

| 2016 |

Gary Dalton |

| 64 |

| 2013 |

Michael Faust |

| 58 |

| 2017 |

Alan B. Menkes |

| 59 |

| 2018 |

Jeff Hastings Brian Beatty, L. Melvin Cooper, Gary Dalton, Michael Faust, Michael Kass and Jacob Mercer.

Mr. Hastings

Mr. Hastings hasbrings extensive business, managerial and leadership experience to the Board. With over 35 years of experience in the geophysical industry. We believeindustry, Mr. Hastings provides the Board with a vital understanding and appreciation of the Company’s business. The Company believes that Mr. Hastings is qualified to serve on ourthe Board based on his extensive knowledge of SAE and his experience in the geophysical industry.

Brian Beatty

Mr. Beatty is the Chief Operating Officer upon consummation of the Restructuring in mid-2016. Prior toCompany and a member of the Restructuring,Board. Mr. Beatty was ourserved as President and Chief Executive Officer and a member of ourthe Board of Directors since the consummationfrom 2011 to his election as Chief Operating Officer and a member of the MergerBoard in 2013.2016. He founded Former SAE in 2006 and served as the President and Chief Executive Officer of Former SAE from its inception. Prior to founding Former SAE, Mr. Beatty held many positions with Veritas DGC Inc., beginning as a seismic field manager and eventually managing all of Veritas’ South American operations and establishing Veritas’ business in Peru, Chile, Argentina, Brazil, and Bolivia.

Mr. Beatty has over 30 years of experience in the geophysical industry working in numerous different geographies. We believeThe Company believes that Mr. Beatty is qualified to serve on ourthe Board based on his extensive knowledge of SAEthe Company and his experience in the geophysical industry.

L. Melvin Cooper

Mr. Cooper has served as the Senior Vice President and Chief Financial Officer of Forbes Energy Services Ltd. (Nasdaq: FES)(OTC: FLSS) (“Forbes”), a public company in the energy services industry.industry, since 2007. Forbes filed for financial reorganization under Chapter 11 of the U.S. Bankruptcy Code in January 2017 and successfully emerged in April 2017. Prior to joining Forbes, in 2007, Mr. Cooper served in financial or operating roles of various companies involved in oilfield site preparation, serving new home builders, providingconstruction, supply chain management, and other industries. Since October 2010, Mr. Cooper has served on the Board of Directors of Flotek Industries, Inc. (NYSE: FTK), where he is a member of the Nominating and Corporate Governance, Audit, and Compensation Committees. Since August 2012, Mr. Cooper has served on the Board of Directors of Par Pacific Holdings, Inc. (NYSE: PARR), where he is a member of the Audit, and Nominating and Corporate Governance Committees. Mr. Cooper received thea Board Leadership Fellow certification from the National Association of Corporate Directors (“NACD”) where he is also a member of the Board of Directors of the NACD Houston/Austin/San Antonio Chapter. Mr. Cooper earned a degree in accounting from Texas A&M University-Kingsville (formerly Texas A&I)University–Kingsville in 1975 and is a Certified Public Accountant. We believe

The Company believes that Mr. Cooper is qualified to serve on ourthe Board based on his public company experience, operational experience, and financial expertise.

Gary Dalton

Mr. Dalton has beenserved as the President of Latash Investments LLC, an investment advisory firm based in Alaska, since 2001. He previously served as Chief Financial Officer and Executive Vice President at National Bank of Alaska for more than 20 years. Prior to joining National Bank of Alaska, he worked for the Comptroller of the Currency as a Bank Examiner. Mr. Dalton is a Trustee of the Alaska Permanent Fund Corporation and a Board member of the Alaska Museum Foundation. He graduated from the University of Puget Sound. We believe

The Company believes that Mr. Dalton is qualified to serve on ourthe Board based on his investment and financial expertise.

Michael Kass

Mr. Faust has over 35 years of industry, financial and leadership experience within the oil and natural gas sector, including diverse geological, geophysical and reservoir experience spanning many different basins and formations throughout the world. Since March 2019, Mr. Faust has served as the President and Chief Executive Officer of Obsidian Energy Ltd. (TSX: OBE) (“Obsidian”), age 44, became a member of ourCanadian-listed public company in the oil and natural gas industry, and has also served on its Board of Directors upon consummation of the Restructuring in mid-2016. He is a Senior Research Analyst at BlueMountain Capital Management, LLC ("BlueMountain") concentrating on stressed and distressed credit across multiple industry sectors. Previously,its Operations and Reserves Committees since April 2018. Since March 2019, Mr. Kass was a co-founder and Head of Research at 3-Sigma Value Management. Prior to 3-Sigma, Mr. Kass served for several years as a Vice President in Lehman’s Global Restructuring Group, where he advised debtors, financial sponsors and government-sponsored enterprises in bankruptcy proceedings in sectors including aviation, media and natural resources. Prior to Lehman, Mr. Kass was an Associate at Miller Buckfire and Co., focusing on restructurings in telecom, industrials, and restaurants. He began his career at McKinsey and Co., which he joined after receiving his JD magna cum laude from Harvard Law School, his BSE in International Finance from Wharton, and his BA summa cum laude from University of Pennsylvania. We believe that Mr. Kass is qualified to serve on our Board based on his investment and financial expertise.

The Company believes that Mr. Faust is qualified to serve on ourthe Board based on his oil and natural gas services industry knowledge and investment and financial expertise.

Alan B. Menkes

Mr. Menkes currently serves as the Managing Partner of Empeiria Capital Partners, a private equity firm that he co–founded in 2002. Prior to founding Empeiria, from 1998 through 2002, Mr. Menkes was Co–Director of Private Equity and a member of the Executive Committee of Thomas Weisel Partners, during which period he also served on the boards of directors of a number of companies including Stellent Inc., a public company. Mr. Menkes currently serves as Chairman of the Board of Directors of Tank Partners Holdings LLC, a company controlled by Empeiria, and was previously on the Boards of Integrated Drilling Equipment Holdings, a public company, Stella Environmental Services and Conner Steel Products Holdings. From 2011 to 2012, Mr. Menkes served as the CEO of Empeiria Acquisition Corp., a public special purpose acquisition company until it closed its merger with an operating company in December 2012. From 2009 through 2010, Mr. Menkes served as the managing partner of G2 Investment Group LLC, a diversified asset management firm. Between 2007 and 2008, Mr. Menkes was a Partner of Enterprise Infrastructure Ventures, a real estate investment firm, and the Chief Strategic and Investment Officer of CS Technology, an affiliate of Enterprise Infrastructure Ventures. Mr. Menkes earned a B.A. in Economics with Highest Distinction from the University of Virginia in 1980 and a M.B.A. with Distinction from the Wharton School at the University of Pennsylvania in 1982.

The Company believes that Mr. Menkes is qualified to serve on the Board based on his significant investment and leadership skills and board experience.

The Company is governed by the Board and its various committees. The Board and its committees have general oversight responsibility for the affairs of the Company. In exercising its fiduciary duties, the Board represents and acts on behalf of the Company’s stockholders.

The Company adheres to the rules of Nasdaqthe NASDAQ Capital Market (“NASDAQ”) in determining whether a director is independent. OurThe Board of Directors consults with our counsel to ensure that the Board’s determinations are consistent with those rules and all relevant securities and other laws and regulations regarding the independence of directors. The Nasdaq listing standardsNASDAQ corporate governance requirements define an “independent director” as a person, other than an executive officer of a company or any other individual having a relationship which, in the opinion of the issuer’s Board of Directors,board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Consistent with these considerations, ourthe Board of Directors has affirmatively determined that Messrs. Cooper, Dalton, Faust Kass, and MercerMenkes are independent directors.

In accordance with Nasdaq listingNASDAQ requirements, ourthe Company’s Board is comprised of a majority of independent directors our Board nomineesand the Nominating, Compensation and Audit Committees are selected by a Nominating Committee comprised entirely of independent directors, and we maintain a Compensation Committeeall comprised entirely of independent directors. OurAt regular Board meetings, the Company’s independent directors have regularly scheduled meetings atmeet separately in executive sessions during which only directors who are independent are present.

The Board does not have a general policy regarding the separation of the roles of Chairman and Chief Executive Officer, or CEO. The Company’s By–laws permit these positions to be held by the same person, and the Board believes that it is in the best interests of the Company to retain flexibility in determining whether to separate or combine the roles of Chairman and CEO based on the Company’s circumstances at a particular time.

Mr. Hastings currently serves as both the Chairman of the Board and the CEO of the Company. The Board has determined that it is appropriate for Mr. Hastings to serve as both Chairman and CEO because it provides an efficient structure that permits the Company to present a unified vision to its constituencies.

In March 2018, the Board appointed Mr. Faust to serve as Lead Independent Director. The Lead Independent Director (i) presides over all meetings of the independent directors, are present.

The Company expects its directors to attend all Board meetings and any meetings of committees of which they are members and to spend the time needed and meet as frequently as necessary to properly discharge their responsibilities. EachThe Board held five meetings in 2018, and each of ourthe Company’s current directors attended all of these meetings. Although the meetings of the Board and meetings of committees of which he was a member in fiscal year 2016 after which he was appointed other than Mr. Faust who was not appointed until January 2017. Although we doCompany does not have any formal policy regarding director attendance at stockholder meetings, we will attemptthe Company attempts to schedule ourits meetings so that all of our directors can attend.attend in person or by phone. All of ourthe Company’s directors attended our 2016 annual meetingthe 2018 Annual Meeting of stockholders other than Mr. Faust who was not appointed until January 2017.

The Board has a standing Audit Committee, consisting of Messrs. Cooper, Dalton and Faust, a standing Compensation Committee consistingand Nominating Committee. Committee members and committee chairs are appointed by the Board. The current members of Messrs. Cooper, Dalton and Mercer, and a standing Nominating Committee, consisting of Messrs. Dalton, Kass and Mercer.

Director | Audit Committee | Compensation Committee | Nominating Committee | |||

Jeff Hastings | ||||||

Brian Beatty | ||||||

L. Melvin Cooper | Chairman | X | ||||

Gary Dalton | X | Chairman | X | |||

Michael Faust | X | |||||

Jacob Mercer | X | Chairman | ||||

Alan B. Menkes | X |

Each committee of the Board believes that combining the role of Chairman and Chief Executive Officer is in the best interests of our company and our stockholders. Having a combined role, places one person in a positionfunctions pursuant to guide the Board in setting priorities for us and in addressing the risks and challenges we face in our operations. In addition, the Board believes that, while independent directors bring a diversity of skills and perspectives to the Board, the Chief Executive Officer, with his extensive knowledge of our businesses and full time focus on our business affairs, makes a more effective Chairman than an independent director, especially given the industry and nature of our business.

Audit Committee is to oversee our financial reporting and disclosure process.

The Audit Committee’s duties, which are specified in the Audit Committee charter, include, but are not limited to:

assisting the Board in its oversight of (i) the Company’s accounting and financial reporting processes; (ii) the integrity of the Company’s consolidated financial statements; (iii) the Company’s compliance with legal and regulatory requirements; (iv) the qualifications and independence of the Company’s independent registered public accounting firm; and (v) the performance of the Company’s independent registered public accounting firm and internal audit function;

appointing, compensating, retaining and overseeing the Company’s independent registered public accounting firm;

reviewing and discussing with management and the independent auditorregistered public accounting firm the annual auditedand quarterly consolidated financial statements and recommendingearnings releases, including determining whether to recommend to the Board whether the audited consolidated financial statements should be included in our annual report onthe Company’s Form 10-K;10–K;

pre–approving all related-party transactions;

reviewing the activities and organizational structure of ourthe Company’s internal audit function and advising on the selection, performance or removal of ourthe Company’s internal audit director, if we appoint one has been appointed, and any outside consultants hired to perform the internal audit function;

assisting the Board in its oversight of major risk assessment and risk management policies; and

reviewing and approving all related party transactions.

The Board has determined that Mr. Cooper is an “audit committee financial expert” as defined under the independent auditorrules and the internal audit director (or outside consultants performing such function), reviewing the integrity of our financial reporting processes (both internal and external) and internal control structure (including disclosure controls and procedures and internal control over financial reporting).

The Audit Committee held four meetings in 2018. Each of the Audit Committee members attended all of the meetings.

Compensation Committee Information

The Compensation Committee’s duties, which are “financially literate,” as defined under Nasdaq’s listing standards. The Nasdaq listing standards define an “independent director” as a person, other than an executive officer of a company or any other individual having a relationship which,specified in the opinionCompensation Committee charter, include, but are not limited to, establishing the overall executive compensation philosophies and policies of the issuer’s Board of Directors, would

The Compensation Committee had four meetings in 2018. Each of the members of the Compensation Committee attended all of the meetings.

Nominating Committee Information

The Nominating Committee has a written charter,Committee’s duties, which is available on our website at

The Nominating Committee had four meetings in 2018. Each of ourthe Nominating Committee members attended all of the meetings ofmeetings.

The Nominating Committee has the responsibility for identifying, evaluating and recommending director candidates to the Board. In identifying potential candidates, the Nominating Committee after which they were appointed to the Nominating Committee.

should have demonstrated notable or significant achievements in business, education or public service;service, and have a reputation consistent with that of the image and reputation of the Company;

should possess the requisite intelligence, education and experience to make a significant contribution to the Board of Directors and bring a range of skills, diverse perspectives and backgrounds to its deliberations;

should have knowledge of usthe Company and issues affecting us;it; and

should have the highest ethical standards, a strong sense of professionalism and intense dedication to serving the interests of ourthe Company’s stockholders.

The Nominating Committee considers a number of qualifications relating to management and leadership experience, background and integrity and professionalism in evaluating a person’s candidacy for membership on our Board of Directors.the Board. The Nominating Committee may require certain skills or attributes, such as independence or financial or accounting experience, to meet specific Board needs that arise from time to time and will also consider the overall experience and makeup of its members to obtain a broad and diverse mix of Board members.

Diversity is one of the various factors the Nominating Committee may consider in identifying director nominees, but the Nominating Committee does not have a formal policy regarding board diversity. All director candidates, including candidates appropriately recommended by stockholders, are evaluated in accordance with the process described above.

As a result of the Company’s restructurings in 2016 and 2017 and in accordance with the Company’s Third Amended and Restated Certificate of Incorporation, as amended, and its By–laws, Whitebox Advisors LLC (“Whitebox”) and Highbridge Capital Management, LLC (“Highbridge”) each have the right to choose one director to be nominated for so long as each of their common stock holdings exceed 9% of the total shares outstanding. At this time, neither Whitebox nor Highbridge has nominated a director to be elected at the Annual Meeting.

The Nominating Committee does not distinguish among, and will consider, nominees recommended by stockholders and other persons.

A related person transaction is defined as a transaction, arrangement or relationship in which the Restructuring

any executive officer, director or nominee for election as a director;

any person who is known by the Company to be comprisedthe beneficial owner of seven directors.more than 5% of the Company’s common stock;

any immediate family member of any of the executive officers, directors or nominees for election as a director, or beneficial owner of more than 5% of the Company’s common stock; and

any firm, corporation or other entity in which any of the foregoing persons is a partner or principal or in a similar position or in which such persons has a 10% or greater beneficial ownership interest.

The Audit Committee is responsible for reviewing and approving all related person transactions to determine whether any such transaction impairs the independence of a director or presents a conflict of interest on the part of a director, employee or officer.

Mr. Hastings owns and controls Speculative Seismic Investments, LLC (“SSI”). In 2018, SSI was a lender under the Company’s senior loan facility in the principal amount of $642,571. Interest paid to SSI in 2018 totaled $77,189.

Mr. Hastings is also a lender under the Company’s senior credit facility. In 2018, the largest principal amount outstanding was $750,000. Mr. Hastings was paid $794,427 of principal and $50,583 of interest in 2018. As of April 26, 2019, Mr. Hastings has $366,667 of principal amount outstanding under the senior credit facility and a maximum commitment of $500,000.

In September 2018, the Company issued 6% Senior Secured Convertible Notes due 2023 (the “2023 Notes”). Mr. Hastings was an initial purchaser of $1.0 million principal amount of the 2023 Notes, and he was paid $13,167 of interest in 2018.

Code of Business Conduct and Ethics

The Company has adopted a Code of Business Conduct and Ethics (the “Code”) for its directors, officers and other employees. A copy of the Code is available on the investor relations section of the Company’s website, www.saexploration.com. If the Company makes any substantive amendments to the Code or grants any waiver to the Code, the Company will disclose the nature of such amendment or waiver on the Company’s website or in a Current Report on Form 8–K filed with the SEC.

The Board’s Role in Risk Oversight

Management is responsible for managing the risks that the Company faces. The Board was initially six members, butis responsible for overseeing management’s approach to risk management. The involvement of the final director appointment was made on January 11, 2017. full Board in reviewing the Company’s strategic objectives and plans is a key part of the Board’s assessment of management’s approach and tolerance to risk. While the Board has ultimate oversight responsibility for overseeing management’s risk management process, various committees of the Board assist it in fulfilling that responsibility.

The Audit Committee assists the Board in its oversight of risk management in the areas of financial reporting, internal controls and compliance with legal and regulatory requirements. The Compensation Committee assists the Board in its oversight of the evaluation and management of risks related to the Company’s compensation policies and practices.

The Board now consists of: one memberbelieves that this division of seniorresponsibilities is the most effective risk management Jeff Hastings, four directors chosen by the Supporting Holders, including one member of senior management, Messrs. Brian Beatty,

Stockholders and Mercer,other interested parties can communicate directly with Mr. Dalton serving as Chairman. Eachany of the members of the Compensation Committee is independent under the applicable Nasdaq listing standards. The Compensation Committee hasCompany’s directors, including its non–employee directors, by sending a written charter, which is available on our websitecommunication to a director c/o Brent Whiteley, Chief Financial Officer, General Counsel and Secretary at

Director Compensation Committee is to review and approve

The table below shows the compensation paid to our officers and directors and to administer our incentive compensation plans, including authority to make and modify awards under such plans.

Name |

| Fees Earned or Paid in Cash |

|

| Stock Awards (1) |

|

| Total |

| |||

L. Melvin Cooper |

| $ | 95,000 |

|

| $ | 100,000 |

|

| $ | 195,000 |

|

Gary Dalton |

|

| 80,000 |

|

|

| 100,000 |

|

|

| 180,000 |

|

Michael Faust |

|

| 91,000 |

|

|

| 100,000 |

|

|

| 191,000 |

|

Alan B. Menkes (2) |

|

| 68,959 |

|

|

| 100,000 |

|

|

| 168,959 |

|

Michael Kass (2) |

|

| 6,041 |

|

|

| — |

|

|

| 6,041 |

|

Jacob Mercer (3) |

|

| — |

|

|

| 100,000 |

|

|

| 100,000 |

|

(1) | Under the terms of the Company’s Amended and Restated 2018 Long–Term Incentive Plan (the “Plan”), each independent director received an annual grant of $50,000 of equity for Board and committee service. In addition to these awards, each independent director also received a discretionary grant of $50,000 of equity under the Plan. |

(2) | Effective January 29, 2018, Mr. Kass resigned from the Board and was replaced by Mr. Menkes. |

(3) | When the stock compensation described above was granted, Mr. Mercer, the director designated by Whitebox, made an election to allow Whitebox to receive the stock compensation in all cash. |

For services performed in 2018, each non–employee director received cash fees of one or more members of the Board who are not “nonemployee directors” the authority to grant awards to eligible persons who are not then subject to Section 16 of the Exchange Act. The Board may also appoint one or more directors or officers to make grants of awards to employees who are not executive officers under Section 16 of the Exchange Act.

Each director may make an election by the date of our annual meeting of stockholders each year to receive the annual cash compensationfees described above in the equivalent value in shares of the Company’s common stock. If so elected, the number of shares grantedsuch director will be based onautomatically granted an award of common stock, restricted stock or restricted stock units under the cash compensation amount owed forPlan. No director made such an election in 2018.

Each independent director may elect to defer the quarter divided by the averagedelivery of the last sale prices forproceeds of the three consecutive trading days afterequity awards discussed above until the earnings releaseearlier of (i) the date for each quarter. Prior to August 3, 2016, each non-employee director received $25,000 annuallyof a change–in–control (as defined in cash for Boardthe Plan), (ii) the independent director’s separation from service payable quarterlyas defined in advance.the Plan or (iii) the independent director’s death. In addition,the event of a change–in–control (as defined in the Plan), each independent director servingwill fully vest in his or her outstanding equity awards so long as the independent director continues to be an independent director through the date of the change–in–control. Messrs. Cooper, Dalton, Faust and Menkes made such an election in 2018.

Proposal 2 — Advisory Vote to Approve Executive Compensation (Say–on–Pay)

This advisory vote on a committee received $50,000 annuallyexecutive compensation, required by Section 14A of the Exchange Act and referred to as the “say–on–pay” vote, gives stockholders the opportunity to express their views on the Company’s named executive officers’ compensation, as disclosed in cashthis proxy statement pursuant to Item 402 of Regulation S–K. Stockholders may vote for committee service,or against the approval of the Company’s executive compensation, or they may abstain from voting on this proposal.

As described in detail in the “Executive Compensation” section beginning on page 15, the primary objectives in designing the Company’s executive compensation program are to attract, retain and motivate the talent needed to lead and grow the Company, reward successful performance and more closely align executives’ interests with those of the Company and its stockholders. The ultimate objective of the Company’s compensation program is to improve the intrinsic value of the Company and long–term stockholder value.

The Company encourages you to review the compensation tables and the Chairmannarrative disclosures on compensation in this proxy statement. The Compensation Committee and the Board believe that the Company’s executive compensation program is effective in implementing the Company’s compensation philosophy and achieving its goals.

The Company requests stockholder approval of our Audit Committee receivedthe compensation of its named executive officers as disclosed pursuant to the SEC’s compensation disclosure rules. This vote is not intended to address any specific item of compensation, but rather the overall compensation of the Company’s named executive officers and the philosophy, policies and practices described in this proxy statement. Accordingly, the Company is asking its stockholders to vote “FOR” the following non–binding resolution at the Annual Meeting:

“RESOLVED, that the stockholders approve, on an additional $20,000 annuallyadvisory basis, the compensation of the named executive officers as disclosed in cash, in each case payable quarterly in advance.

Adoption of the say–on–pay proposal requires the affirmative vote of a majority of the issued and outstanding shares of the Company’s common stock available for issuance underpresent in person or represented by proxy at the plan from 2,962 shares to 400,000 shares. In addition, the Non-Employee Director

The Board recommends that you vote “FOR” the resolution, on an advisory basis, approving the executive compensation of the named executive officers.

Proposal 3 — Advisory Vote on the Frequency of Future Say–on–Pay Votes

Section 14A of the Exchange Act requires the Company to submit a non–binding, advisory resolution to stockholders at least once every six years to determine whether advisory votes on executive compensation, such as Proposal 2 of this proxy statement, should be held every one, two, or three years. At the Annual Meeting, stockholders will select the frequency of say–on–pay votes by approving a resolution in one of the following forms:

RESOLVED, that the stockholders determine, on an advisory basis, that the frequency with which the stockholders should have an advisory vote on the compensation of the named executive officers as disclosed in the form of a grant of a number of shares of our common stock equalproxy statements for its annual meetings pursuant to $50,000 divided by the averagecompensation disclosure rules of the last sale prices of our common stock forSecurities and Exchange Commission is:

Choice 1 — every year;

Choice 2 — every two years;

Choice 3 — every three consecutive trading days after the third quarter earnings release date, which will be vested upon issuance. years; or

Choice 4 — abstain.

The directors designated for nomination to the Company’s Board of Directors by Whitebox Advisors LLChas determined that holding a say–on–pay vote every one year is consistent with its policies and BlueMountain Capital Management, LLC may make an election by the annual meeting date each year to receive the stockpractices for evaluating and determining compensation described above in all cash rather than stock. As of April 24, 2017, a total of 16,213 shares had been awarded under the Non-Employee Director Plan.

The frequency of oursay–on–pay vote is advisory, and therefore not binding on the Company, the Board, or the Compensation Committee.

Adoption of the frequency of say–on–pay proposal requires the affirmative vote of a plurality of the issued and outstanding shares of common stock for three consecutive trading days afterpresent in person or represented by proxy at the Company's third quarter 2016 earnings release dateAnnual Meeting and entitled to vote thereon.

The Board recommends that stockholders vote “FOR” one year (Choice 1) on the proposal recommending the frequency of November 3, 2016. Messrs. Cooper and Dalton each received 7,508 shares of our common stock pursuantadvisory votes on future say–on–pay votes.

This section explains the Company’s executive compensation program as it relates to those awards,the Principal Executive Officer and the shares vested upon issuance. Messr. Kass elected to receive the awards described above in all cash rather than stock. Messr. Mercer elected not to receive the award described above for 2016.

Name(1) | Fees Earned or Paid in Cash ($) | Stock Awards ($)(2) | All Other Compensation ($) | Total ($) | ||||||||

| L. Melvin Cooper | 40,788 | 64,118 | — | 104,906 | ||||||||

| Gary Dalton | 77,147 | 64,118 | — | 141,265 | ||||||||

Michael Faust(3) | — | — | — | — | ||||||||

| Michael Kass | 82,201 | — | — | 82,201 | ||||||||

| Jacob Mercer | 21,467 | — | — | 21,467 | ||||||||

| Gregory R. Monahan | 37,500 | — | — | 37,500 | ||||||||

| Eric S. Rosenfeld | 37,500 | — | — | 37,500 | ||||||||

| David D. Sgro | 47,500 | — | — | 47,500 | ||||||||

Name | Age | Position | ||

Jeff Hastings |

61 | |

Chief Executive Officer, Chairman of the Board and Director | ||||

Brian Beatty | 56 | Chief Operating Officer and Director | ||

Brent Whiteley | 53 | Chief Financial Officer, General Counsel, and Secretary | ||

This discussion may include statements regarding financial and Brian Beatty can be foundoperating performance targets in the section entitled “

Overview of the Merger in 2013 to completion of the Restructuring in mid-2016. He served as Chief Operating Officer, Chief Financial Officer, General Counsel and Secretary of Former SAE beginning in March 2011, but resigned as Chief Operating Officer in November 2011. Previously, Mr. Whiteley served as General Counsel-Western Hemisphere and then in January 2008 became a Senior Vice President of CGG Veritas, operating its North and South American land acquisition business. Mr. Whiteley holds a BBA in finance/real estate from Baylor University, a JD from South Texas College of Law, and an MBA from Rice University — Jesse H. Jones Graduate School of Management.

The Compensation Committee has over 30 years of experience in the geophysical services industry. Prior to joining SAE, Mr. Silvernagle worked for 17 years with Veritas, Veritas DGC Land and finally CGG Veritas, Mr. Silvernagle held a variety of roles with those companies including Technical Manager of North America, Technical Manager of North and South America and, ultimately, VP of Resources for the Global Land Division. In these roles, Mr. Silvernagle managed all aspects of technical operations in both field and office locations. His assignments included the diverse operating environments of Canada, the Canadian Arctic, the North Slope of Alaska, the U.S. Lower 48, the Middle East and South America. Mr. Silvernagle spent 10 years in the field in supporting roles for all aspects of crew operations.

Objectives of Business Administration degree in Finance from the University of St. Thomas in Houston, Texas.

The Company’s compensation program seeks to provide total compensation packages that are competitive in terms of potential value to ourits executives, and which are tailored to ourits unique characteristics and needs within ourits industry in order to create an executivea compensation program that will adequately reward ourits executives for their roles in creating value for our stockholders. We intendthe Company’s stockholders to beachieve the following objectives to:

attract and retain talented executive officers by providing reasonable total compensation levels competitive with otherthat of executives holding comparable positions in similarly situated companiesorganizations;

provide total compensation that takes into account individual performance;

provide performance–based compensation that balances rewards for short–term and long–term results and takes into account both the individual’s and the Company’s performance; and

encourage the long–term commitment of the Company’s executive officers to the Company’s and its stockholders’ long–term interests.

Elements of the Compensation Program

To accomplish the Company’s objectives, the Company seeks to offer a total direct compensation program to its executives that, when valued in our industry.

base salary;

cash performance bonus;

long–term incentive awards; and stock incentive bonus and stock-based awards. We view the three

benefits.

The Company views these components of executive compensation as related but distinct. Although our compensation committeethe Compensation Committee reviews total compensation, we dothe Company does not believe that significant compensation derived from one component of compensation should negate or reduce compensation from other components. We determineThe Company determines the appropriate level for each compensation component based in part but, not exclusively, on ourits view of internal equity and consistency, individual performance and any other information deemed relevant and timely. The Compensation Committee is in the process of developing policies for allocating compensation between long-term and currently paid out compensation, between cash and non-cash compensation, and among different forms of compensation.

In addition to the guidance provided by ourthe Compensation Committee, wethe Company may utilize the services of third parties from time to time in connection with the hiring and compensation awarded to executive employees. This could include subscriptions to executive compensation surveys and other databases and recommendations regarding compensation.

To provide stability and equity holdingsappropriate incentive, Messrs. Hastings, Beatty and Whiteley are all parties to determine whether they provide adequate incentives and motivation to executive officers and whether they adequately compensate the executive officers relative to comparable officers in other companies.

| Name and Principal Position | Year | Salary ($) | Stock Awards ($) | Option Awards ($) | Non-Equity Incentive Plan ($) | All Other Compensation ($) | Total ($) | ||||||||||||||||||

Jeff Hastings CEO, Chairman of the Board | 2016 | 628,069 | 1,013,807 | (1) | 343,380 | (2) | 642,058 | (4) | 81,489 | (10) | 2,708,803 | ||||||||||||||

| 2015 | 591,948 | — | (3) | — | (3) | 733,880 | (5) | 57,711 | (10) | 1,383,539 | |||||||||||||||

Brian Beatty COO | 2016 | 616,818 | 1,013,807 | (1) | 343,380 | (2) | 642,058 | (6) | 38,094 | (11) | 2,654,157 | ||||||||||||||

| 2015 | 591,948 | — | (3) | — | (3) | 733,880 | (7) | 47,510 | (12) | 1,373,338 | |||||||||||||||

Brent Whiteley CFO, General Counsel and Secretary | 2016 | 423,850 | 722,713 | (1) | 272,682 | (2) | 345,138 | (8) | 61,295 | (13) | 1,825,678 | ||||||||||||||

| 2015 | 399,475 | — | (3) | — | (3) | 385,700 | (9) | 49,606 | (14) | 834,781 | |||||||||||||||

| MIP Awards ($) | 2016 Performance Award ($) | Total Stock Awards ($) | ||||||

Jeff Hastings CEO, Chairman of the Board | 692,778 | 321,029 | 1,013,807 | |||||

Brian Beatty COO | 692,778 | 321,029 | 1,013,807 | |||||

Brent Whiteley CFO, General Counsel and Secretary | 550,144 | 172,569 | 722,713 | |||||

Base Salary

Base salaries are the foundation of the Company’s executive compensation program. They provide a fixed baseline level of cash compensation based on each executive officer’s position, experience, level of responsibility, individual job performance, contributions to the Company’s corporate performance, job tenure and future potential. Base salary levels also impact amounts paid under other elements of the Company’s executive compensation program including cash performance bonuses and long–term incentive awards.

The Initial Employment Agreements provided for initialemployment agreements, which were effective as of January 29, 2018, set base salaries for 2018 as follows: JeffMr. Hastings ($489,000); Brian552,780), Mr. Beatty ($489,000);552,780) and BrentMr. Whiteley ($330,000)403,410). The executives were guaranteed a five percent annual salary increase and as much as a 15% salary increase if certain criteria are met. On August 13, 2013,employment agreements also provide that, for any calendar year during the term of the employment agreements in accordance withwhich the Initial Employment Agreements, our Compensation

Cash Performance Bonus

The Company includes an annual cash performance bonus as part of its compensation program because the Company believes this element of compensation provides each executive officer the opportunity to receive a cash performance bonus based on the achievement of specified performance goals by such executive officer.

The performance goals that determine the amount of the cash performance bonuses for Messrs. Hastings, Beatty and Whiteley are defined in each employment agreement and are tied to Free Cash Flow targets, EBITDA targets, individual performance targets and health, safety and environment (“HSE”) targets. For Mr. Hastings, these performance goals for any calendar year are set by 10%. The Initial Employment Agreements providedthe Compensation Committee and the Board. For Messrs. Beatty and Whiteley, these performance goals are set by the Compensation Committee after consultation with Mr. Hastings.

In the event that the Company’s Free Cash Flow for participationthe prior calendar year is less than $15 million, the employment agreements provide an annual cash performance bonus with (i) an annual target amount of 35% of base salary and a guaranteed annual cash performance bonus of at least 17.5% and as much as 52.5% of base salary for Messrs. Hastings and Beatty, and (ii) an annual target amount of 30% of base salary and a guaranteed annual cash performance bonus of at least 15% and as much as 45% of base salary for Mr. Whiteley, in our 2013 Long-Term Incentive Plan (the "2013 Plan")each case, if certain performance goals are achieved.

In the event that the Company’s Free Cash Flow for the prior calendar year is greater than $15 million, the employment agreements provide an annual cash performance bonus with (i) an annual target amount of 100% of base salary and a guaranteed annual cash performance bonus of at least 50% and as much as 150%, of base salary for Messrs. Hastings and Beatty, and (ii) an annual target amount of 80% of base salary and a guaranteed annual cash performance bonus of at least 40% and as much as 120%, for Mr. Whiteley, of twelve times such executive’s highest paid monthly base salary within the calendar year. In addition, the executives each received a monthly automobile allowance.

As the Company’s Free Cash Flow for 2018 was less than $15 million, cash performance bonuses for 2018 (paid in 2019) for Messrs. Hastings and Beatty were $125,757 and for Mr. Whiteley was $78,665.

Long–Term Incentive Awards

The long–term incentive awards deliver a targeted percentage of base salary withinto each executive officer based on the applicableachievement of long–term goals of the Company.

The Compensation Committee approved the long–term incentive awards plan to promote retention of executive officers, increase the proportion of their total performance–based compensation, and provide an incentive to achieve the Company’s long–term strategic and financial goals.

In the event that the Company’s Free Cash Flow for the prior calendar year is less than $15 million, the employment agreements provide a target aggregate value of long–term incentive awards with (i) a target value of 60% of base salary for Messrs. Hastings and Beatty, and (ii) equity compensationa target value of 40% of base salary for Mr. Whiteley.

In the event that the Company’s Free Cash Flow for the prior calendar year is greater than $15 million, the employment agreements provide a target aggregate value of long–term incentive awards with (i) a target value of amount of 20% of base salary for Messrs. Hastings and Beatty, and (ii) a target value of 13% of base salary for Mr. Whiteley.

As the Company’s Free Cash Flow for 2018 was less than $15 million, long–term incentive awards for 2018 (granted in 2019) for Messrs. Hastings and Beatty were $215,584 and for Mr. Whiteley was $104,887.

In addition to be grantedthe long–term incentive awards described above and in accordance with their employment agreements, the 2016 Plan which included grants on September 26, 2016 (the “MIP Awards”) ofCompany also awards restricted stock or restricted stock units entitling(“RSUs”) under a Management Incentive Program (the “MIP”) to the recipient to receive sharesexecutive officers. In 2018, Messrs. Hastings and Beatty were each awarded 146,720 RSUs and Mr. Whiteley was awarded 116,512 RSUs. In 2019, based on the recommendation of our common stock upon vesting (88,252 shares for Mr. Hastings 88,252 shares forand upon approval of the Compensation Committee, Messrs. Hastings and Beatty were each awarded an additional 157,760 RSUs and Mr. Whiteley was awarded 125,279 RSUs, of which one–half vested in April 2019 and one–half will vest in January 2021.

Benefits

The Company believes in a simple, straight–forward compensation program and, as such, Messrs. Hastings, Beatty and 70,082 sharesWhiteley are not provided unique perquisites or other personal benefits other than their monthly car allowances and payments of the premiums on their health and life insurance policies. Consistent with this strategy, no other perquisites or personal benefits have, or are, expected to exceed $10,000 for Mr. Whiteley), and stock options (88,252 for Mr.Messrs. Hastings, 88,252 for Mr. Beatty and 70,082 for Mr. Whiteley) at exercise prices determined based on volume-weighted average prices (as describedWhiteley.

The Company provides company benefits that it believes are standard in the Amendedindustry. These benefits consist of a group medical, dental and Restatedvision insurance program for employees and their qualified dependents, group life insurance for employees and retirement savings plans.

How Elements of the Compensation Program are Related to Each Other

The Company views the various components of compensation as related but distinct and emphasizes “pay for performance” with a significant portion of total compensation reflecting a risk aspect tied to long–term and short–term financial and strategic goals. The Company’s compensation philosophy is to foster entrepreneurship at all levels of the organization by making long–term equity–based incentives a significant component of executive compensation. The Company determines the appropriate level for each compensation component based in part, but not exclusively, on its view of internal equity and consistency, and other considerations it deems relevant, such as rewarding extraordinary performance.

The Compensation Committee, however, has not adopted any formal or informal policies or guidelines for allocating compensation between long–term and currently paid out compensation, between cash and non–cash compensation, or among different forms of non–cash compensation.

The following table provides summary information concerning the compensation of the Named Executive Officers for the years ended December 31, 2018 and 2017:

Name and Principal Position |

| Year |

| Salary |

|

| Stock Awards (1) |

|

| Non-Equity Incentive Plan (2) |

|

| All Other Compensation (3) |

|

| Total |

| |||||

Jeff Hastings |

| 2018 |

| $ | 559,703 |

|

| $ | 3,902,752 |

|

| $ | 125,757 |

|

| $ | 67,098 |

|

| $ | 4,655,310 |

|

CEO, Chairman of the Board |

| 2017 |

|

| 614,383 |

|

|

| — |

|

|

| 562,207 |

|

|

| 89,138 |

|

|

| 1,265,728 |

|

Brian Beatty |

| 2018 |

|

| 559,703 |

|

|

| 3,902,752 |

|

|

| 125,757 |

|

|

| 36,759 |

|

|

| 4,624,971 |

|

COO |

| 2017 |

|

| 614,383 |

|

|

| — |

|

|

| 562,207 |

|

|

| 37,396 |

|

|

| 1,213,986 |

|

Brent Whiteley |

| 2018 |

|

| 403,410 |

|

|

| 3,099,219 |

|

|

| 78,668 |

|

|

| 55,098 |

|

|

| 3,636,395 |

|

CFO, General Counsel and Secretary |

| 2017 |

|

| 414,615 |

|

|

| — |

|

|

| 303,522 |

|

|

| 67,217 |

|

|

| 785,354 |

|

(1) | Reflects the grant date fair value of RSU awards for each Named Executive Officer computed in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718. The Company determines the grant date fair value of the awards by multiplying the number of RSUs granted by the closing price of one share of the Company’s common stock on the award grant date. These amounts do not reflect the actual economic value that will be realized by the Named Executive Officer upon the vesting or the sale of the RSUs. There were no RSU awards made in 2017. In accordance with their employment agreements, Messrs. Hastings and Beatty were each awarded 146,720 RSUs and Mr. Whiteley was awarded 116,512 RSUs as MIP awards in 2018. These awards were to vest as follows: (a) one–fourth on July 29, 2019, (b) one–fourth on January 29, 2020 and (c) one–half on January 29, 2021. In August 2018, the Board accelerated the vesting of the RSUs that were to vest on July 29, 2019 and January 29, 2020. |

(2) | Represents the amounts earned under the Company’s non–equity incentive plan for 2018 and 2017, respectively. Amounts were paid in 2019 and 2018, respectively. |

(3) | Represents payment of monthly automobile allowances ($2,750/month for both Mr. Hastings and Mr. Beatty and $1,750/month for Mr. Whiteley) and the payment of the premiums on health and life insurance policies. |

Outstanding Equity Awards at Fiscal Year-End

The following table sets forth certain information with respect to outstanding restricted stock unit awards at December 31, 2018:

Name |

| Number of Shares or Units of Stock That Have Not Vested (1) |

|

| Market Value of Shares or Units of Stock That Have Not Vested (2) |

| ||

Jeff Hastings |

|

| 73,360 |

|

| $ | 137,183 |

|

Brian Beatty |

|

| 73,360 |

|

|

| 137,183 |

|

Brent Whiteley |

|

| 58,256 |

|

|

| 108,939 |

|

(1) | These restricted stock units issued as MIP awards vest on January 29, 2021. |

(2) | Based on the closing price of the Company’s common stock on December 31, 2018 of $1.87. |

Termination of Employment Agreements,and Change–in–Control Provisions

Messrs. Hastings, Beatty and Whiteley are each party to employment agreements which provides them with post–termination benefits in a variety of circumstances. The amount of compensation payable in some cases may vary depending on the 2016 Plannature of the termination, whether as a result of retirement/voluntary termination, involuntary not–for–cause termination, termination following a change of control and in the awardevent of disability or death of the executive.

The employment agreements for such stock unitsMessrs. Hastings, Beatty and options) and during the periods specified therein.

In the event of termination of an executive’sthe executive officer’s employment due to his death or permanent disability (as defined in the Amended and Restated Employment Agreements).

The employment agreements for each executive, as well as under the Initial Employment Agreement for each executive, each such executive waived the termination by a change of control provision, and the corresponding provisions of his prior employment agreement, and any right to claim any such compensation and benefits in connection with the Restructuring.

| Option Awards | Stock Awards | |||||||||||

| Name | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($) | ||||||

| Jeff Hastings | — | 88,252 | $10.19 | 9/26/2026 | 88,252 | $644,240 | ||||||

| Brian Beatty | — | 88,252 | $10.19 | 9/26/2026 | 88,252 | $644,240 | ||||||

| Brent Whiteley | — | 70,082 | $10.19 | 9/26/2026 | 70,082 | $511,599 | ||||||

The Plan allows for the issuance of stock options (both incentive and non–qualified), stock appreciation rights, restricted stock awards, restricted stock units, other stock–based awards and cash–based awards. As of December 31, 2018, there were 2,750,000 shares authorized for issuance under the Plan, which includes 1,791,056 shares of common stock that may be issued in respect of MIP Awards. No more than 100,000 shares of common stock may be granted as incentive stock options under the Plan to any single participant during any single calendar year.

The following table provides information aboutas of December 31, 2018, concerning the Company’s securities authorized for issuance under equity compensation plans at December 31, 2016:plans:

Plan Category |

| Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights (1) |

|

| Weighted- Average Exercise Price of Outstanding Options, Warrants and Rights |

|

| Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in the First Column) |

| |||

Equity compensation plans approved by security holders |

|

| 363,357 |

|

| $ | — |

|

|

| 2,127,726 |

|

Equity compensation plans not approved by security holders |

|

| — |

|

|

| — |

|

|

| — |

|

Total |

|

| 363,357 |

|

| $ | — |

|

|

| 2,127,726 |

|

| Plan Category | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights | Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plan (Excluding Securities Reflected in the First Column) | |||||||

| Equity compensation plans approved by security holders | 622,954 | $ | 5.10 | 799,091 | ||||||

| Equity compensation plans not approved by security holders | — | — | — | |||||||

| Total | 622,954 | $ | 5.10 | 799,091 | ||||||

(1) | Includes 104,440 RSUs that were awarded to certain of the independent directors where delivery has been deferred. |

The following table sets forth, information as of April 24, 2017,26, 2019, information regarding the beneficial ownership of ourthe Company’s common stock by:

each person, or group of affiliated persons, who is known by the Company to be the beneficial owner ofbeneficially own more than five percent of our outstanding shares5% of common stock;

each of our Directorsthe Company’s directors and our Named Executive Officers;named executive officers; and

all current Executive Officersof the Company’s directors and Directorsnamed executive officers as a group.

Beneficial ownership is determined according to the rules of the SEC and generally means that a person has beneficial ownership of a security if he, she, or it possesses sole or shared voting or investment power of that security, including warrants that are currently exercisable or exercisable within 60 days of April 26, 2019. Shares issuable pursuant to warrants are deemed outstanding for computing the percentage of the person holding such equity instruments but are not outstanding for computing the percentage of any other person. Except as indicated we believeby the footnotes below, the Company believes, based on the information furnished to it, that allthe persons named in the table below have sole voting and investment power with respect to all shares of common stock shown that they beneficially owned by them.own, subject to community property laws where applicable. The information does not necessarily indicate beneficial ownership for any other purpose.

The calculation of the percentage of beneficial ownership is based on 4,290,697 shares of common stock outstanding as of April 26, 2019.

Unless otherwise indicated, the address of each beneficial owner listed in the table below is 1160 Dairy Ashford Rd., Suite 160, Houston, TX 77079.

Beneficial Ownership as of April 24, 2017 (2) | ||||||||||

Name and Address of Beneficial Owner(1) | Amount and Nature of Beneficial Ownership | Approximate Percentage of Beneficial Ownership | ||||||||

| Directors and Executive Officers: | ||||||||||

Jeff Hastings(3) | 134,207 | (4) | 1.4 | % | ||||||

| Gary Dalton | 7,807 | * | ||||||||

L. Melvin Cooper(5) | 7,508 | * | ||||||||

| Brent Whiteley | 2,227 | * | ||||||||

Mike Scott(3) | 382 | * | ||||||||

Darin Silvernagle(3) | 289 | * | ||||||||

Brian Beatty(3) | 197 | * | ||||||||

| Ryan Abney | 61 | * | ||||||||

Michael Kass(6) | — | — | ||||||||

Jacob Mercer(7) | — | — | ||||||||

| Michael Faust | — | |||||||||

| All directors and executive officers as a group (11 persons) | 152,678 | 1.6 | % | |||||||

| Five Percent Holders: | ||||||||||

Whitebox Advisors LLC (8) | 2,609,039 | 27.9 | % | |||||||

BlueMountain Capital Management, LLC(9) | 2,409,106 | 25.7 | % | |||||||

FMR LLC(10) | 788,877 | 8.4 | % | |||||||

John P. Pecora(11) | 622,798 | 6.7 | % | |||||||

Name and Address of Beneficial Owner |

| Shares Beneficially Owned |

|

| Percentage Beneficially Owned |

| ||

5% Beneficial Owners: |

|

|

|

|

|

|

|

|

Whitebox Advisors LLC (1) |

|

| 1,994,356 |

|

| 32.56% |

| |

DuPont Capital Management Corp.(2) |

|

| 613,144 |

|

| 14.20% |

| |

BlueMountain Capital Management, LLC (3) |

|

| 449,779 |

|

| 9.99% |

| |

Highbridge Capital Management, LLC (4) |

|

| 437,632 |

|

| 9.88% |

| |

Morgan Stanley Investment Management Inc. (5) |

|

| 344,451 |

|

| 8.03% |

| |

Ducera LLC (6) |

|

| 242,795 |

|

| 5.66% |

| |

Officers and Directors: |

|

|

|

|

|

|

|

|

Jeff Hastings (7) |

|

| 118,939 |

|

| 2.77% |

| |

Brent Whiteley |

|

| 96,991 |

|

| 2.26% |

| |

Brian Beatty (8) |

|

| 86,028 |

|

| 2.00% |

| |

Mike Scott (9) |

|

| 32,529 |

|

| * |

| |

Ryan Abney |

|

| 21,330 |

|

| * |

| |

Darin Silvernagle (10) |

|

| 15,255 |

|

| * |

| |

L. Melvin Cooper (11) |

|

| 375 |

|

| * |

| |

Gary Dalton |

|

| — |

|

|

| — |

|

Jacob Mercer (12) |

|

| — |

|

|

| — |

|

Michael Faust |

|

| — |

|

|

| — |

|

Alan Menkes |

|

| — |

|

|

| — |

|